A charity credit card is a convenient way of supporting a charity. Most of these cards utilize a model where the credit card issuer will donate money based on the size of your purchases with the card.

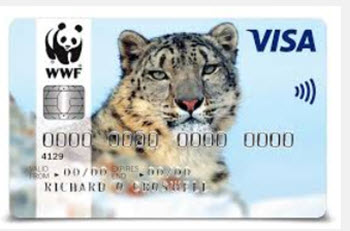

Example: You get a WWF VISA charity credit card from Bank of America, a charity credit card where the beneficiary is the World Wildlife Foundation (WWF). Each time you make a purchase with this VISA card, Bank of America will donate 0.25 percent of the amount to WWF. So, when you pay a $50 dinner, Bank of America donates $0,125 to WWF.

Example: You get a WWF VISA charity credit card from Bank of America, a charity credit card where the beneficiary is the World Wildlife Foundation (WWF). Each time you make a purchase with this VISA card, Bank of America will donate 0.25 percent of the amount to WWF. So, when you pay a $50 dinner, Bank of America donates $0,125 to WWF.

What’s good about charity credit cards?

- It is a very easy way of donating.

- You are not donating your own money.

- For many charitable credit cards, the issuer will make an initial donation (e.g. $100) to the charity when you first activate the credit card.

- For many charitable credit cards, the issuer will make a yearly donation independent of your spending, as long as you keep the account open.

What’s bad about charity credit cards?

- Even though you aren’t donating your own money, you are most likely – in a way – paying for the donation by accepting less stellar credit card terms than what you would have gotten if you simply picked the best credit card for your life style.

- You can not claim a tax deduction for the donations.

- Only a few charities are the beneficiaries of charity credit cards. You can’t find a charity credit card that would support your local independent cat shelter.

Do the math before you decide

In some situations, it is better to simply pick the credit card that is best for you and make your own donations instead of routing them through a credit card issuer.

In the example above, Bank of America donates an amount equal to 0.25% of each purchase with the WWF Visa. If you purchase a total of $20,000 using your card in a year, Bank of America makes a $50 donation.

Now, take a look at the credit card that is actually best suited for you. The one that gives you the best discounts, the best free insurance, the best cash back, and so on. How much would you save by using this card for a year instead, making $20,000 in purchases? Is it more or less than $50?

If you save $200 by using the non-charity credit card, both you and WWF will actually come out on top if you donate $75 and pocket $125. You could even give $100 to the local cat shelter and still be in the black.